- Article

- Managing Cash Flow

- Enable Growth

How your business can benefit from Import Solutions

Trade Finance: Indonesia’s Import Landscape

With a growing economy and changing regulatory outlook, Indonesia's dynamic import landscape is fast becoming a key player in global trade. Increasing Indonesian market competition is attracting foreign investment and providing greater opportunity to become a global import partner. The Omnibus Law has also helped encourage global investment, simplifying the import and export process to improve trade infrastructure and regulation. As Indonesia’s import landscape continues to evolve and increase in competition, the opportunities for businesses to engage in global sales and establish supply chains continues to grow in terms of scale and the opportunities on offer.

Importing to Indonesia – what are the potential issues?

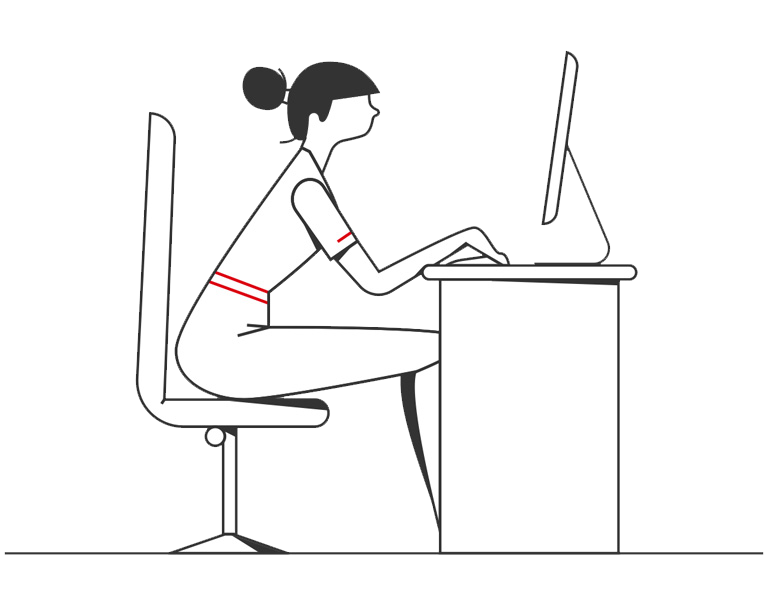

Despite the opportunities global trade can open-up, establishing strong import relations can be challenging, especially within global supply chains. The delay between payment and sale of goods can create cashflow vulnerabilities, leaving you in a weakened position to negotiate import trade terms with suppliers. Supplier relations can also become strained if you are unable to provide assurances of your ability to meet payments or if suppliers fail to provide oversight of import documentation regarding your goods. The nature of international trade means every business has their own unique trading cycle; it is therefore important when engaging in import and export activities to be aware of the weaknesses and vulnerabilities distinct to your trade cycle.

Import Finance Solutions

To effectively manage these potential challenges, import finance solutions can help you negotiate the complexities of global trade and ensure the success of your import and export activities. Import letters of credit optimise your working capital when paying for imports up front, by funding the gap between incoming and outgoing funds. This helps speed up access to liquidity to strengthen your cashflow position and improves your ability to negotiate more favourable import agreements. Letters of guarantee can also help strengthen supplier relations by assuring payment on your behalf, whilst our documentary collection solutions can give you peace of mind the correct goods have been shipped before making payment.

HSBC Indonesia’s Import Finance Solutions

- Letters of Credit

On presenting the correct documents HSBC will pay suppliers on behalf of a business, ensuring imported goods have been shipped before payment is issued. Different types of Letter of Credit import finance solutions include: - UPAS (Usance Letters of Credit Payable at Sight)

Payment is issued for imported goods at sight of the correct import documentation. - UPAU (Usance Letters of Credit Payable at Use)

Payment is issued for imported goods within an extended credit period once the correct import documentation has been received. - Import Documentary Collection

Only once a supplier's bank has presented the correct shipping documents will payment be released for imported goods. Documentary Collections provide payment assurances to suppliers as well as confirmation that goods have been shipped as per agreed specifications. - Shipping Guarantee

To receive imports quicker a shipping guarantee allows a business to claim goods without all transport documents. This reduces delays and ensures business opportunities aren’t missed. - Avalisation

This trade finance solution provides assurance of payment to suppliers should a business default on a Bill of Exchange at maturity. Such assurance helps facilitate new trading relationships and negotiation of more favourable import terms.